Accounting is integral to any business, providing the foundation for financial management and decision-making. Among the various tools and techniques used in accounting, accounting ledgers stand out as crucial instruments for organizing and tracking financial transactions. In this article, we will explore how accounting ledgers can transform your business, offering enhanced efficiency, accuracy, and insights into your company’s financial health.

Table of Contents

Understanding the Importance of Accounting Ledgers

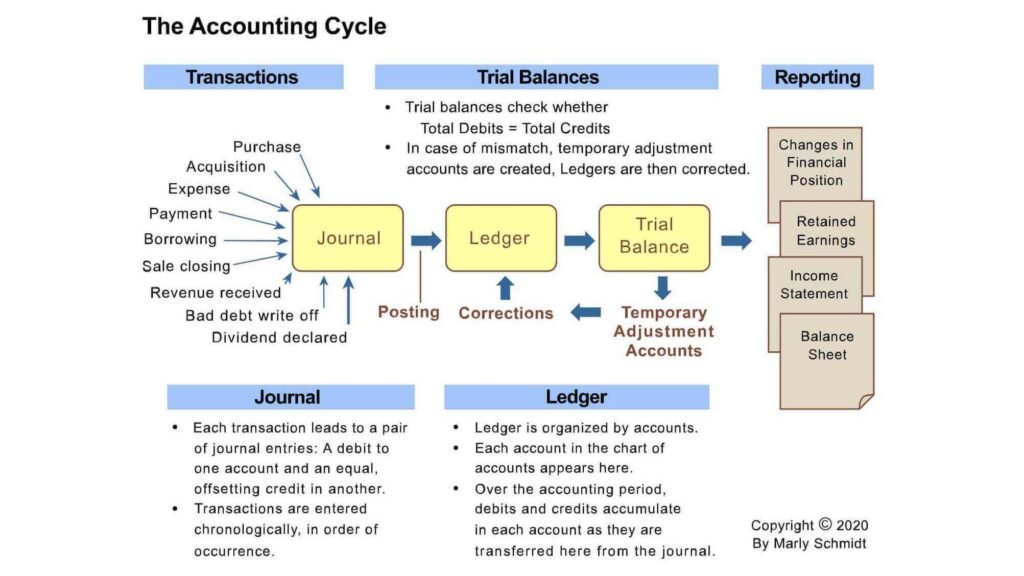

Accurate and detailed record-keeping is vital for any business, regardless of its size or industry. An accounting ledger serves as a central repository for all financial transactions, including income, expenses, assets, and liabilities. By diligently maintaining an accounting ledger, you create a comprehensive financial history that can be invaluable for monitoring cash flow, assessing profitability, and preparing financial statements.

Streamlining Financial Data Management with Accounting Ledgers

Efficient management of financial data is crucial for the success of any business. Accounting ledgers provide a structured framework for organizing and categorizing transactions, making it easier to locate specific information when needed. With the advent of computerized accounting systems, digital ledgers have become increasingly popular, allowing for automated data entry, quick search capabilities, and seamless integration with other financial software.

Enhancing Accuracy and Compliance

One of the primary benefits of using accounting ledgers is the increased accuracy they bring to financial record-keeping. By recording transactions promptly and consistently, you reduce the risk of errors and ensure that your financial statements provide an accurate representation of your company’s financial position. Moreover, maintaining detailed and up-to-date ledgers facilitates compliance with tax regulations, audit requirements, and financial reporting standards.

Gaining Valuable Insights for Decision-Making

Accounting ledgers offer more than just a record of financial transactions; they provide valuable insights that can guide strategic decision-making. By analyzing ledger data, business owners and managers can identify trends, evaluate the performance of different departments or products, and make informed choices regarding resource allocation, cost reduction, and revenue optimization. These insights enable proactive decision-making, positioning your business for growth and success.

Tracking Cash Flow and Financial Health

Maintaining a clear and accurate picture of your company’s cash flow is essential for effective financial management. Accounting ledgers play a critical role in tracking cash inflows and outflows, allowing you to monitor your business’s liquidity, identify potential cash flow bottlenecks, and plan for future expenses or investments. Regularly reviewing your ledger enables you to make informed decisions about budgeting, managing debt, and optimizing working capital.

Facilitating Audits and Financial Analysis

During audits or financial analysis, accounting ledgers serve as a reliable source of information that can be used to assess the accuracy and reliability of your financial statements. Auditors and financial analysts rely on ledgers to verify the completeness and validity of transactions, ensuring compliance with accounting principles and regulations. Well-maintained ledgers streamline the auditing process, reducing the time and effort required for examination.

Integration with Financial Software and Systems

With advancements in technology, accounting ledgers can be seamlessly integrated with various financial software and systems. This integration enhances the efficiency of data entry, reduces manual errors, and enables real-time access to financial information. By connecting your accounting ledger with other software, such as inventory management or payroll systems, you can streamline processes, eliminate duplicate data entries, and ensure data consistency across different systems.

Leveraging Automation for Time and Resource Savings

The digitization of accounting processes, including ledger management, has revolutionized the way businesses handle their finances. Automated accounting systems can significantly reduce the time and effort required for ledger maintenance. Features like automatic transaction categorization, bank statement reconciliation, and financial report generation save valuable resources, allowing you and your team to focus on strategic initiatives and core business activities.

Safeguarding Financial Information and Preventing Fraud

Properly maintained accounting ledgers contribute to robust financial data security and help prevent fraud. By implementing internal controls and regularly reconciling ledger entries, you can identify discrepancies or anomalies that may indicate fraudulent activities. Segregation of duties, limited access to financial records, and regular audits of ledger transactions contribute to a secure financial environment, protecting your business’s assets and reputation.

Embracing the Power of Accounting Ledgers for Business Success

Accounting ledgers are indispensable tools that transform the way businesses manage their finances. From streamlining data management and enhancing accuracy to providing valuable insights for decision-making, accounting ledgers offer a multitude of benefits. Embracing digital ledgers and leveraging automation further amplifies these advantages, enabling businesses to save time, reduce errors, and focus on growth. By implementing robust accounting practices and harnessing the power of accounting ledgers, you set your business on a path to financial success and prosperity.

Conclusion

Accounting ledgers are the backbone of effective financial management, offering numerous advantages for businesses of all sizes. From accurate record-keeping and streamlined data management to valuable insights for decision-making, the benefits of accounting ledgers are undeniable. As technology advances, businesses must embrace the digital transformation of accounting processes and leverage automation to optimize efficiency and productivity. By harnessing the power of accounting-ledger your business can enhance financial accuracy, ensure compliance, and gain a competitive edge in today’s dynamic business landscape. Make accounting-ledger a cornerstone of your financial operations, and witness the transformative impact they can have on your business’s growth and success.

Learn about: Unveil the pivotal role of standard cost accounting in the realms of law and finance, providing accurate insights and informed decision-making for organizational success.