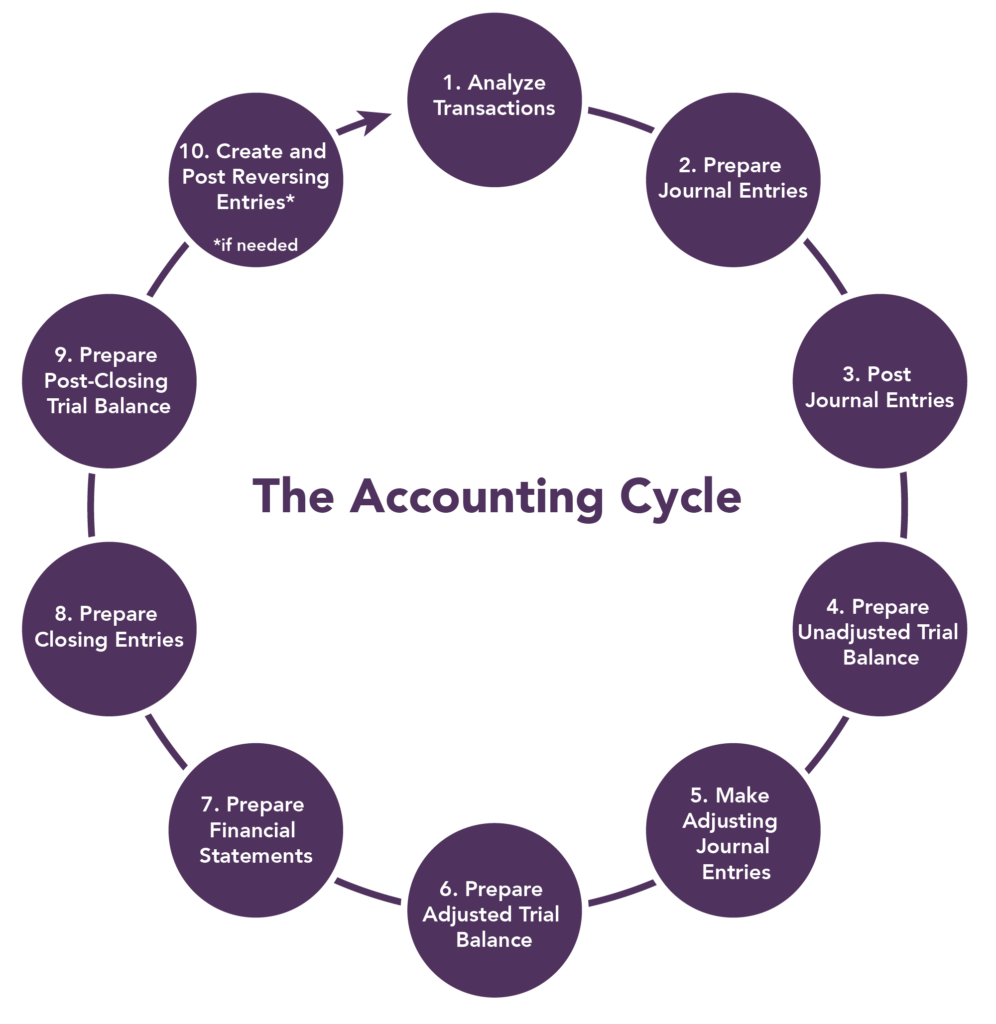

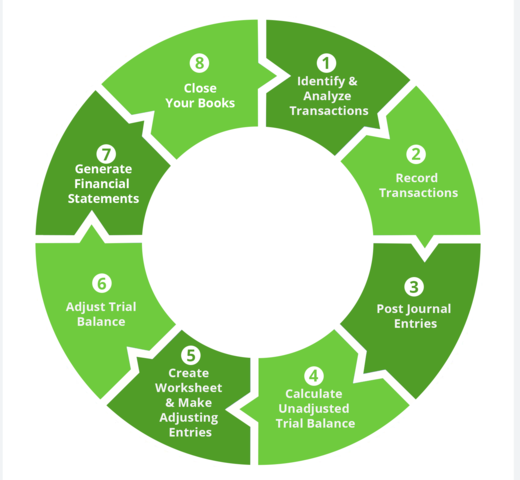

Understanding the accounting cycle is crucial for businesses of all sizes. It is a systematic process that ensures accurate financial record-keeping and helps in making informed business decisions. The steps of the accounting cycle provide a framework for organizing and analyzing financial information. In this article, we will explore each step in detail, highlighting its significance and explaining how it contributes to the overall accounting process.

Table of Contents

Analyzing Transactions

The first step of the accounting cycle is analyzing transactions. In this phase, accountants review and examine all financial transactions to determine their impact on the company’s financial statements. This involves identifying which steps of the accounting cycle are affected, whether there are any changes in assets, liabilities, or equity, and whether the transaction has a revenue or expense component.

Recording Journal Entries

After analyzing transactions, the next step is to record journal entries. Journal entries provide a chronological record of all financial transactions and their respective impacts on the accounts. Each entry consists of a debit and a credit entry, ensuring that the accounting equation (Assets = Liabilities + Equity) remains balanced. Accurate and timely recording of journal entries is vital for maintaining reliable financial records.

Posting to the General Ledger

Once the journal entries are recorded, they need to be posted to the general ledger. The general ledger is a master record that contains all the accounts of a company. Posting involves transferring the information from the journal entries to the appropriate accounts in the general ledger. These steps of the accounting cycle help in maintaining a centralized and organized record of all financial transactions.

Preparing an Unadjusted Trial Balance

After posting to the general ledger, an unadjusted trial balance is prepared. The trial balance lists all the account balances, including their debit or credit nature, before any adjustments are made. It serves as a preliminary check to ensure that the total debits equal the total credits, providing an initial indication of the accuracy of the accounting records.

Making Adjusting Entries

Adjusting entries are necessary to bring the accounts up to date and reflect the accrual basis of accounting. These entries are made at the end of the accounting period and ensure that revenues and expenses are recognized in the appropriate period. Adjusting entries also account for items such as prepaid expenses, accrued revenues, and accrued expenses. These entries fine-tune the financial statements, providing a more accurate representation of the company’s financial position.

Preparing an Adjusted Trial Balance

Once the adjusting entries have been made, an adjusted trial balance is prepared. This trial balance includes the updated steps of the accounting cycle balances after the adjustments. Similar to the unadjusted trial balance, the adjusted trial balance ensures that the debits still equal the credits. It serves as a crucial step in verifying the accuracy of the adjusting entries.

Generating Financial Statements

With the adjusted trial balance as a foundation, the next step is to generate financial statements. These statements, including the income statement, balance sheet, and statement of cash flows, provide a comprehensive overview of a company’s financial performance, position, and cash flow. Financial statements are essential for internal and external stakeholders to assess the company’s financial health.

Closing the Books

Closing the books marks the end of an accounting period and prepares the accounts for the next period. During this step, temporary accounts such as revenue, expense, and dividend accounts are closed by transferring their balances to the retained earnings account. The purpose is to reset the temporary accounts to zero, ready for the upcoming period. Closing the books ensures the accurate calculation of income for the period and allows for a fresh start in the next steps of the accounting cycle.

Performing a Post-Closing Trial Balance

After the books are closed, a post-closing trial balance is prepared. This trial balance verifies that all the temporary steps of the accounting cycle have been properly closed and that only permanent accounts, such as assets, liabilities, and equity, are reflected. It serves as a final check to ensure the accuracy of the closing process and provides a starting point for the next accounting period.

Conclusion-Steps of the Accounting Cycle

The steps of the accounting cycle form a comprehensive framework for maintaining accurate financial records. From analyzing transactions to generating financial statements and closing the books, each step contributes to the overall accuracy and reliability of financial information. Following these steps diligently ensures that businesses can make informed decisions based on reliable financial data. By understanding and implementing the steps of the accounting cycle, businesses can improve their financial management, comply with reporting requirements, and assess their performance effectively.

Learn about: Discover remote accounting jobs part time that offer flexibility to fit seamlessly into your schedule, providing opportunities for work-life balance and professional growth.